Inflation Reduction Act

The bill includes numerous investments in climate protection, including federal tax credits for households to offset energy costs, investments in clean energy production, and tax credits aimed at reducing carbon emissions. Its aim is to reduce carbon emissions by roughly 40% by 2030.

Energy Efficient Home Improvement (25C) Tax Credit

Who can use this credit? Principal Residence Owners

- Upgrades must be to an existing home and principal residence.

- Renters may be eligible for the tax credit if it is their primary residence and they personally make the improvements.

- Landlords can not use the credits for a home that is not their primary residence.

- New construction does not apply.

A principal residence is the home where you live most of the time. The home must be in the United States. It can include a house, houseboat, mobile home, cooperative apartment, condominium, and a manufactured home.

The summary below is written by Wallace Eannace, based on its council’s interpretation and our understanding. Below should be used as guidance, with final interpretation by you, and or the end user.

(25C) Tax Credit Summary

- Beginning January 1, 2023, a homeowner may receive a federal tax credit of 30% of the total installed cost (product & labor), up to $2,000, for heat pumps, and/or heat-pump water heaters; installed annually.

- Homeowner may claim a 25C tax credit, annually, for 10 years on each heat pump installation through 2032.

- Any installation during the year will be claimed on that year’s taxes. (ex. Heat pump(s) installed in February 2023 are eligible for the tax credit towards 2023 federal taxes owed.

- Homeowner may receive a federal tax credit and a utility rebate for the same project. The utility rebate will be counted towards (deducted from) the total installed cost.

- Homeowner may receive an additional tax credit for improvements to, or replacement of, the electrical panel-boards, sub panel boards, branch circuits, or feeders when installing the eligible heat pump. The credit is 30% of the total installed cost (product & labor), up to $600. The load capacity must be 200 amps or greater.

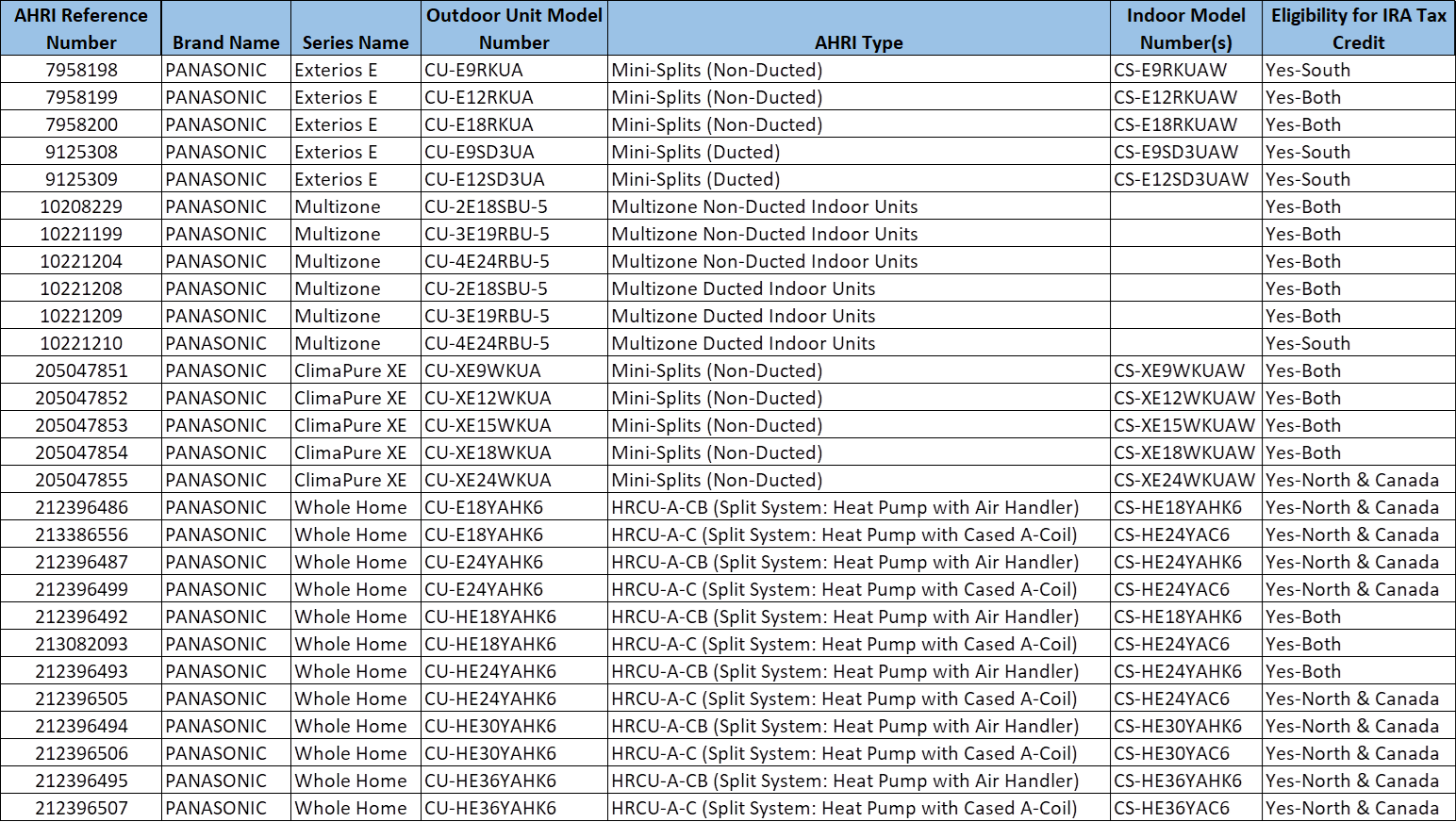

Panasonic 25C Tax Credit Qualified Product List

Consortium for Energy Efficiency (CEE)

For the most current list, please visit https://www.ahrinet.org/certification/cee-directory. Click on Air-Source Heat Pumps (North or South)

For further questions, please contact our main office at 877.326.6223 or your local sales representative. You may also reach out to Terry Pappas, Director North American Sales at tpappas@wea-inc.com.

HVAC Specialty WEA | Master Panasonic HVAC Import Representative – United States